Monday, 18 November 2024

Crypto Staking and Other Crypto Opportunities To Not Miss

by BD Banks

The post Crypto Staking and Other Crypto Opportunities To Not Miss appeared first on Coinpedia Fintech News

The financial world of 2024 is increasingly embracing the idea of creating smart and easy ways of generating passive income. Numerous ideas for passive income exist; ideal not only for beginners but also for well-seasoned investors, including crypto staking, dividend stocks, and even peer-to-peer lending. Let’s dive into the 10 best crypto earning methods.

- Crypto staking

- High-Yield Savings Accounts

- Dividend Stocks

- Peer-to-Peer Lending

- Real Estate Crowdfunding

- Create an Online Course

- Sell Digital Products

- Crypto-lending

- Automated Crypto Trading

- Crypto mining

1. Crypto Staking

Crypto staking is one of the popular options of generating passive income in the crypto world. By staking your digital assets on OkayCoin, you get rewarded for basically just locking up your coins for a certain period. Staking allows you to contribute to securing the blockchain network and confirming the transactions that take place on it, all while earning staking rewards in the form of added coins.

What is OkayCoin?

OkayCoin is considered one of the major cryptocurrency exchange websites that offers an intuitive user interface, rich digital assets, and secure, investing, and staking processes. With features like low commissions, robust security, and different staking plans, OkayCoin has become one of the go-to platforms among investors looking to gain passive income through crypto assets.

How to Sign Up on OkayCoin

OkayCoin allows you to sign up with them in quick and simple steps. Here is how you can get started:

- Accessing the Website: Go to OkayCoin’s website and click the “Sign Up” tab.

- Account Creation: Enter your e-mail address, strong password, and verification if needed.

- Verification of Identity: Further identify yourself with a KYC process, if so required by such a platform, by uploading identification documents.

- Deposit Funds: Fund your account with money via bank transfer, crypto transfer, or whatever other option might be available in the app.

- Start Staking: With your account funded, the next step will be to go to the staking section and select a suitable staking plan for your investment. There is a $100 welcome bonus for you.

Referral Program

If a friend, through your reference, signs up with them and completes their first trade, then both of you are entitled to a reward in the form of crypto bonuses or as a discount in trading and staking fee services. you will get a 3.5% commission of every order.

Moreover, you can get everything in Level 1 plus for all of your friends’ purchases. Further you have the chance to get 1.5% deposited into your account.

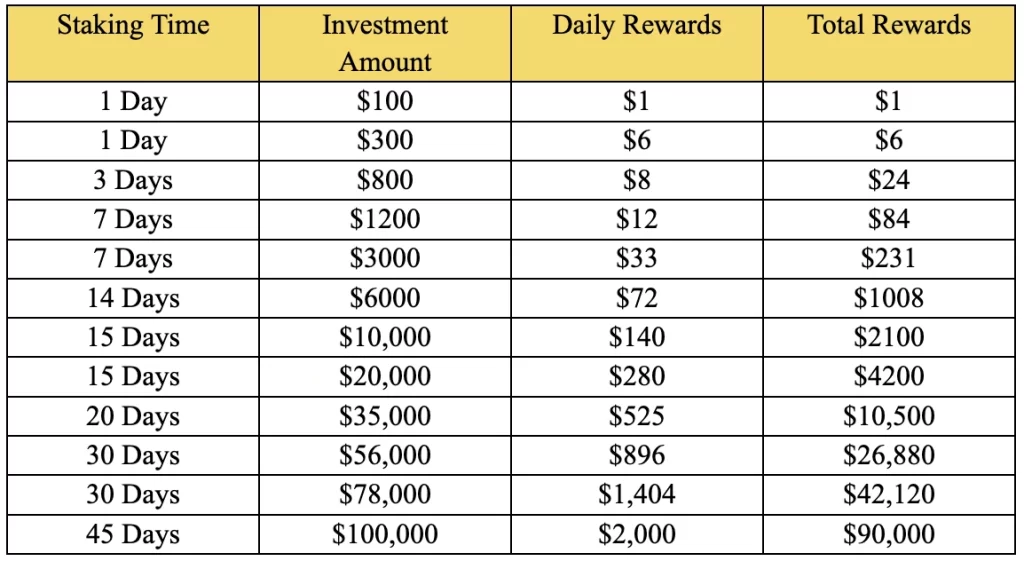

Staking plans of OkayCoin

- Free Trial Staking Plan: $100 for 1 day and earn $1 daily.

- Ethereum Staking Plan: $300 for 1 day and earn $6 daily.

- Polygon Staking Plan: $800 for 3 days and earn $8 daily.

- TRON taking Plan: $1200 for 7 days and earn $12 daily.

- Polkadot Staking Plan: $3000 for 7 days and earn $33 daily.

- Celestia Staking Plan: $6000 for 14 days and earn $72 daily.

- Aptos Staking Plan: $10,000 for 15 days and earn $140 daily.

- Sui Staking Plan: $20,000 for 15 days and earn $280 daily.

- Avalanche Staking Plan: $35,000 for 20 days and earn $525 daily.

- Cardano Staking Plan: $26,880 for 30 days and earn $896 daily.

- Solana Staking Plan: $42,120 for 30 days and earn $1404 daily.

- Ethereum Liquid Staking Pro: $90, 000 for 45 days and earn $ 2000 daily.

2. High-Yield Savings Accounts

Traditionally, high-yield savings have given a way of passive income. Unlike a regular savings account, they let your money grow more because of higher interest rates. They are ideal in that respect for those seeking low risk and easy access to funds in earning interest on cash deposits.

3. Dividend Stocks

Dividend stocks can even provide fantastic avenues for earning regular income. Companies paying dividends give a portion of their profits on a regular basis to shareholders. Once you own shares in such companies, then you are entitled to dividends paid quarterly or annually.

4. Peer-to-Peer Lending

Peer-to-peer lending platforms serve as a conduit for consumers who are borrowers and reach individual investors directly. By lending out your money to creditworthy individuals, you earn interest on your investment. Depending on the borrower’s creditworthiness, your returns may be higher with associated higher risks than a traditional savings account through peer-to-peer lending.

5. Real Estate Crowdfunding

Real estate crowdfunding is one avenue of investment wherein investors pool money together for investment in real estate projects. In such a setup, it provides revenues through rental income and possibly profits through appreciation without having you take care of the property management issues.

6. Create an Online Course

Selling online courses is one lucrative passive income stream if you’re good at some particular field. Once you have been able to develop and publish an online course on platforms such as Udemy or Coursera, you will stand a chance to accrue passive income in sales of the courses without you necessarily managing it.

7. Sell Digital Products

Digital products are things like e-books, printables, and software that create passive income in a continuous manner. Once you’ve created and set it up, the product can be sold over and over again through an online sales channel, thereby generating passive income with minimal ongoing effort. This is quite a popular method among creatives and entrepreneurs to monetize their skills.

8. Crypto-lending

This refers to lending one’s digital assets on any particular lending platform to other borrowers and getting interest out of it. This is considered low-risk passive income because, while the borrower pays the interest, the lender retains ownership of the digital assets.

9. Automated Crypto Trading

It essentially means using bots to buy and sell crypto by reaching certain predetermined conditions. Bots can operate 24/7 with constant programming to act on market conditions rapidly; this, therefore, guarantees an income even on turbulent markets.

10. Crypto mining

This is a process involving blockchains of transaction validation done by a computational device, and as a result, miners get rewarded by allocating new coins. While traditional mining presupposes the involvement of specialized hardware and considerable costs of electricity, some platforms offer an alternative called cloud mining, which allows users to mine without physical equipment.

Conclusion

Having a great number of staking plans, flexible options, and competitive rewards, in 2024, OkayCoin would be a big player in the market. The friendly interface and secure environment would set up the platform as ideal for new and professional investors. OkayCoin would stand for the best opportunities to maximize returns; accordingly, it would stand as the best choice in relation to passive income-related crypto staking in 2024.